Venu Holding (VENU)·Q4 2025 Earnings Summary

VENU Stock Tanks 17% After Hours as Preliminary Q4 Revenue Misses, $75M Offering Announced

January 27, 2026 · by Fintool AI Agent

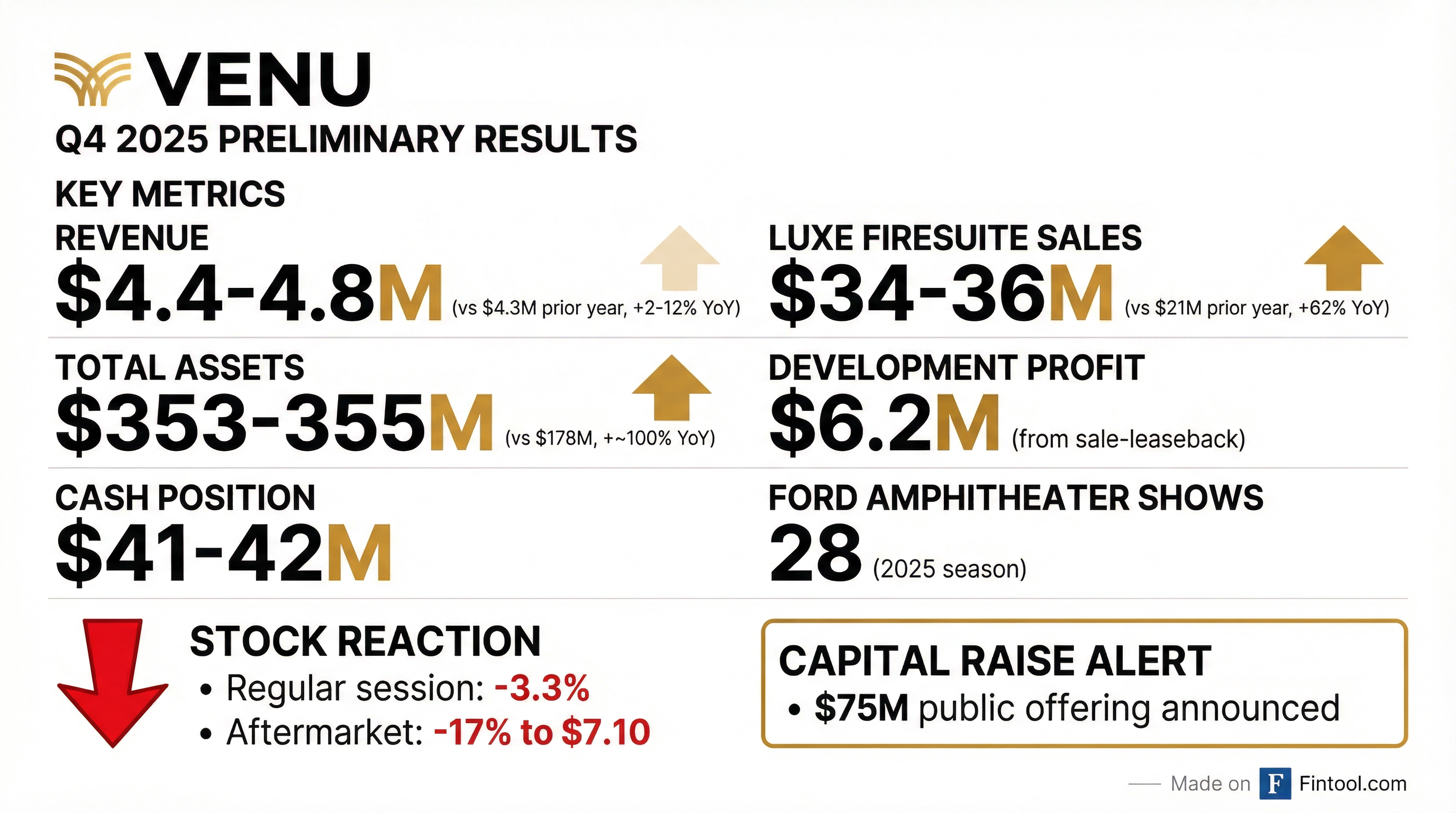

VENU Holding Corporation (NYSE American: VENU), the premium live entertainment venue developer, released preliminary Q4 2025 results today showing modest revenue growth but is getting hammered in after-hours trading after simultaneously announcing a $75 million equity offering that would substantially dilute shareholders.

The stock closed down 3.3% at $8.59 in regular trading, but plunged an additional 17% to $7.10 in after-hours as investors digested the capital raise announcement—bringing shares within striking distance of their 52-week low of $7.05.

Did VENU Beat Earnings?

Preliminary Q4 2025 Results (Unaudited):

VENU's total revenues came in at $4.4-4.8M for Q4 2025, a modest improvement from $4.3M in the year-ago quarter. The company noted that "ticketing revenue is becoming a larger percentage of overall revenue," signaling the anticipated business model shift as venue operations mature.

Full Year 2025 Preliminary:

What About the Balance Sheet?

VENU's balance sheet tells a story of aggressive expansion:

The company recognized $6.2 million in development profit from a sale-leaseback transaction on its Colorado Springs parking property completed in November 2025. This marked VENU's first-ever development profit, a validation of its real estate strategy.

Why Is VENU Raising $75 Million?

The bigger news driving after-hours selling is the $75 million registered public offering of common stock announced alongside earnings.

Proceeds will fund:

- Development of The Sunset McKinney (Texas)

- Development of The Sunset Broken Arrow (Oklahoma)

- Development of The Sunset El Paso (Texas)

- Purchase and development of Centennial, Colorado property

- Working capital and general corporate purposes

Deutsche Bank Securities and ThinkEquity are acting as joint book-runners, with a 30-day option for an additional $11.25M in shares.

At the current market cap of ~$368 million, a $75-86M raise would dilute existing shareholders by approximately 20-23%—a significant haircut that explains the violent after-hours reaction.

How Did the Stock React?

The stock has been under pressure since peaking last summer, declining over 50% as growth-stage losses accumulated and legal concerns emerged. Pomerantz Law Firm has been investigating claims on behalf of VENU shareholders, adding to investor unease.

What Did Management Say?

CEO J.W. Roth struck an optimistic tone despite the dilutive raise:

"There are several main takeaways from our preliminary results. First, as expected, we are now seeing the shift to ticketing revenue becoming a larger percentage of our overall revenue. Second, our restaurant revenue increased 8.6% in the fourth quarter of 2025 with the successful grand opening in mid-November of Roth's Sea & Steak, which completed our Colorado Springs entertainment complex."

Roth reiterated his ambition: "I believe the Company will become operationally profitable by the end of 2026."

This timeline is critical—VENU has been burning cash as it builds out its venue portfolio, with net losses of $6.4M in Q3 2025 alone. The path to profitability depends on successfully opening new venues in McKinney, Broken Arrow, El Paso, and Houston.

What Changed From Last Quarter?

Improvements:

- Restaurant revenue accelerated with Roth's Sea & Steak opening (+8.6% Q4)

- First development profit recognized ($6.2M)

- Ford Amphitheater expanded to 28 shows (up from 20 in 2024 season)

- Luxe FireSuite sales momentum continued (+62% YoY in Q4)

Concerns:

- Significant equity dilution coming ($75-86M raise)

- Debt more than doubled YoY (127-130% increase)

- Legal investigations ongoing

- Stock near 52-week lows despite "strong" results

Ford Amphitheater Performance

The Colorado Springs flagship venue had a productive 2025 season:

Despite more shows, gross receipts per show declined—potentially due to lineup mix or market conditions. Management expects over 35 shows for the 2026 season.

Development Pipeline Update

VENU has an aggressive expansion timeline:

The $75M raise is earmarked for the first three amphitheaters plus the Centennial indoor venue.

Key Risks to Monitor

- Dilution: $75-86M raise at distressed prices significantly impacts existing shareholders

- Execution Risk: Multiple venues under simultaneous construction

- Legal Overhang: Pomerantz investigation creates uncertainty

- Cash Burn: Company still unprofitable with end-2026 profitability target

- Debt Load: Total debt up 127-130% YoY to ~$59M

- Valuation Risk: Stock trading near 52-week lows despite asset growth

The Bottom Line

VENU's preliminary Q4 results show a company executing on its venue development strategy—total assets doubled, FireSuite sales surged 62%, and the company recorded its first development profit. But investors aren't buying the growth story right now.

The simultaneous announcement of a $75M equity raise at depressed prices is the real story here. With shares already down 50%+ from summer highs and a Pomerantz investigation underway, existing shareholders face significant dilution just as the company approaches critical development milestones.

CEO Roth's end-2026 profitability target is the key metric to watch. If VENU can successfully open its Texas and Oklahoma venues while controlling costs, the stock could recover. But the path from here requires flawless execution and patient capital—two things that appear in short supply given today's market reaction.

Note: These are preliminary, unaudited estimates. Actual Q4 2025 results may differ materially when VENU files its 10-K.